The team at EMIRA have vast experience in the Marine Insurance industry which has assisted EMIRA in creating close connections and contacts with the marine insurance markets from around the world. EMIRA is able to comprehensively guide clients to acquire the most suitable insurance for their needs.

Our services extend to the following list of marine insurance risks:

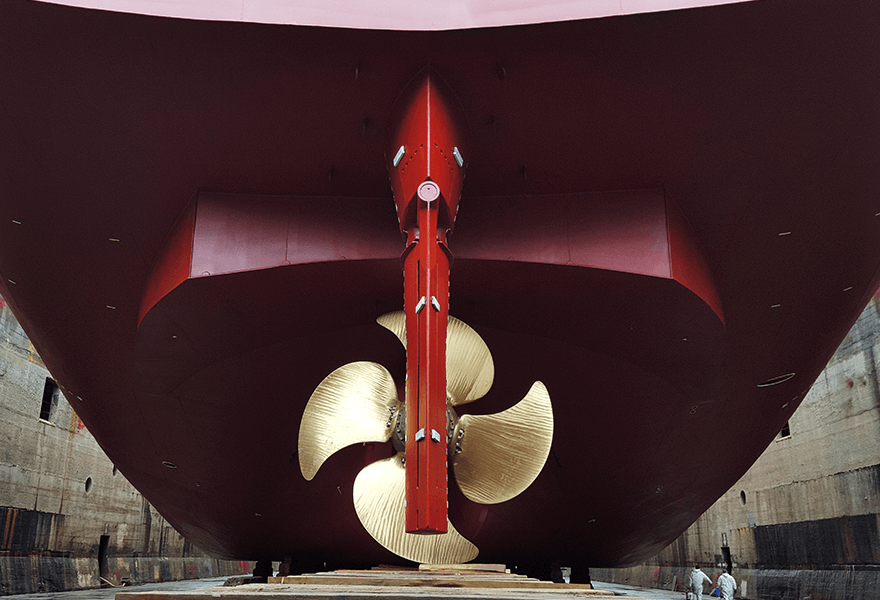

Hull and Machinery Insurance (H&M)

H&M insurance offers protection to shipowners for loss of or damage to their vessel's hull and machinery in instances of marine casualties from engine breakdowns to total loss of or damage to a vessel and is one of the main product lines offered by EMIRA.

Protection and Indemnity Insurance

Equal in importance as Hull & Machinery insurance, Protection and Indemnity insurance is a requisite for vessels, shipowners and charterers to insure against all maritime liability risks encountered through the vessel’s operation. As P&I policies are tailor made, EMIRA works with our clients to achieve optimal cover.

Charterer’s Liability Insurance

Charterer's Liability Insurance offers insurance protection to charterers for risks relating to thirds parties or arising out of contractual liabilities and indemnities. EMIRA assists charterers with obtaining this vital insurance protection.

War & Strikes Risks Insurance

War Risk Insurance offers protection for risks typically not covered by H&M and P&I Policies. EMIRA helps its clients to cover such risks as damage to and loss of the vessel caused by incidents of war, civil war, revolution and rebellion, capture, seizure, arrest, restrain or detention, strikes and labour disturbances, terrorist and piracy.

Kidnap & Ransom Insurance

An ancillary cover, Kidnap and Ransom Insurance is particular in protecting against financial loss should the vessel be hijacked and the crew kidnapped. EMIRA assists clients with obtaining K&R cover which provides vital assistance through ransom payment, negotiations, legal assistance, crew and vessel retrieval and crew injury and rehabilitation costs.

Loss of Hire / Delay Cover

Shipowners and charterers may find themselves unable to trade due to incidents such as collisions or engine breakdown. This loss of revenue can heavily impact the financial resources of shipowners and charterers. While loss of hire insurance will cover shipowners and charterers for the income that was lost due to a delay, cover for specific risks normally not covered under the loss of hire insurance is available for risks such as strikes, port closures and other unexpected events that may cause delays. EMIRA can guide its clients with appropriate cover.

Drug Seizure Insurance

Caught unaware shipowners often find themselves tangled in difficulties due to the crew or passengers smuggling illegal substances using the vessel as a mode of transport resulting in seizure of the vessel. Through EMIRA, shipowners can insure against the losses from such risks and delays through adhoc Drug Seizure Insurance.

Cargo Insurance

Cargo insurance offers coverage against risks deriving from physical loss or damage during the shipment either by land, air or sea. The cargo owners must protect their cargo during the transportation and storage process as typically the cargo will be exposed to varied risks. Considering the type of cargo, methods of transportation and related risks, EMIRA works together with its clients to optimise cover and minimise loss.

Freight Demurrage and Defence Insurance

Parallel to H&M and P&I insurance, FD&D insurance offers protection to shipowners and charterers when faced with legal costs related to disputes associated to the vessel that do not fall within a scope of cover offered by their P&I and H&M insurance. Cover is obtained by EMIRA to protect its clients who own, operate or charter vessels against what can be substantial costs when pursuing or defending claims and disputes.

Yacht Insurance

Yacht Insurance cover can be tailored to fit the clients’ needs. EMIRA can provide insurance for yachts and other pleasure crafts covering hull & machinery, fixtures and fittings, third party liabilities, personal effects, personal accident and loss of hire.

Port Risk Insurance

Offering coverage to vessels that are laid up for lengthy periods of times, such as when undergoing repairs, Port Risk Insurance is designed to cover physical damage to the vessel and other liabilities during the vessels stay in the port area. EMIRA is able to assist owners with placement of cover.

Mortgagee Interest Insurance

A prudent ship financer will ensure that their investment is insured against loss should there be a breach in the cover of the H&M or P&I insurance. EMIRA regularly assists clients in obtaining Mortgagee Interest Insurance offering such cover.